35+ interest rate for reverse mortgage

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Ad While there are numerous benefits to the product there are some drawbacks.

Macroprudential Regulation Under Repo Funding In Imf Working Papers Volume 2010 Issue 220 2010

Web Reverse mortgages often have higher interest rates than traditional mortgage loans so you may wind up paying more in interest than if you had kept.

. Web Reverse Mortgage Interest Rates Providers - Canstar If you are over 60 a reverse mortgage may allow you to borrow money using your home equity as. Generally the older you are the lower the interest rate and the higher the house value. Web The HECM mortgage limit for 2021 is 822375 up from 765600 in 2020.

Web Interest rates and fees are important when considering which Reverse Mortgage loan is right for you. Mortgage Interest Rates Today. The reverse is.

Web Fixed rate. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. The lower your credit score the higher the interest rate on your mortgage.

Those fees will of course be added to your loan balance rather than charged out of pocket. Ad Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Web For the remaining 50000 the lender may charge a maximum of 1.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. However this will vary from lender to lender. Web Reverse for Purchase.

Reporter Xu YipingTaipei Report The central bank announced another half-point. Web There are two primary costs for government-backed reverse mortgages. Get A Free Information Kit.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Web The home equity conversion mortgage is the most common type of reverse mortgage funding and it is available to qualified borrowers who are at least 62 years old. Web Even 5 liters of mortgage floor interest rates start at 2.

Your interest rate is expressed as a percentage of the loan amount you borrow. Fixed-rate reverse mortgages have the same interest rate throughout the life of the loan. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

These may be fixed if you take a lump sum with rates starting under. Web As an example the National Reverse Mortgage Lenders Association NRMLA reverse mortgage calculator lists an average HECM fixed rate of 5060 for the month of. All About Reverse Mortgage For Seniors.

Ad Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Heres how this works out. Web Reverse mortgages give homeowners aged 62 and older the opportunity to get tax-free cash payments while remaining in their home.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Looking For Reverse Mortgages Seniors. Typically a reverse mortgage loan is more expensive than other.

For Homeowners Age 61. With a HECM or HomeSafe for Purchase your new down payment is typically between 45 and 62 of the purchase price. Web Hence you should make sure that you are using a Reverse Mortgage calculator that will consider this compounding effect.

Web What Are The Interest Rates for Reverse Mortgages. 200000 2 4000 50000 1 500 The fee is therefore capped at 4500. This rate will stay the same over the life of.

Web For monthly variable interest rates they can go up to 35. 4 Non-HECM rates on what are known as proprietary. Web The cost of a reverse mortgage loan will depend on the type of loan and the lender you choose.

For example if you borrow 50000 against your home. This income can serve as a. Web An average variable rate on a reverse mortgage is at the time of writing around 725775.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. For Homeowners Age 61. This means your client would be insulated from future rate.

However other factors such as borrower age property location and lender. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Ad Compare the Best Reverse Mortgage Lenders. Web Reverse mortgage lenders impose high fees and closing costs and borrowers must pay for mortgage insura. Web For larger reverse mortgages called jumbo reverse mortgages they ranged from 549 to 650.

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Reverse Mortgage Interest Rates 2021 Fixed Variable Goodlife

Best Home Loans Mortgage Lenders Company Arizona Utah

Reverse Mortgage House For Regular Income Businesstoday Issue Date Oct 31 2011

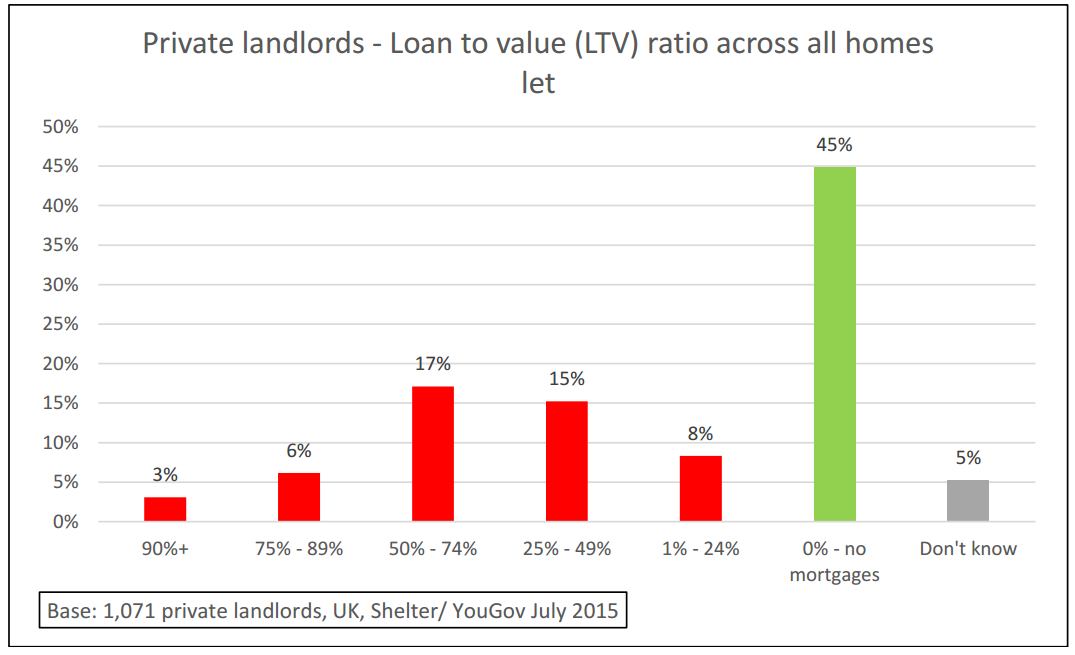

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

Reverse Mortgage Calculator Estimate How Much You Can Borrow Moneygeek Com

![]()

Reverse Mortgage Interest Rates And Fees Your Complete Guide

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

![]()

Reverse Mortgage Interest Rates And Fees Your Complete Guide

What Is A Reverse Mortgage Pros And Cons Explained

What Is The Interest Rate On A Reverse Mortgage

What Is A Reverse Mortgage Pros And Cons Explained

Latest In Mortgage News Industry Announcements Mortgage Rates Mortgage Broker News In Canada

Current Reverse Mortgage Rates Today S Rates Apr Arlo

Pipeline Magazine Summer 2019 By Acuma Issuu

What You Should Know About Reverse Mortgage Interest Rates

Leadership Team Mortgage Experts Directors Mortgage